nh meals tax calculator

0 5 tax on interest and dividends Median household income. A 9 tax is also assessed on motor.

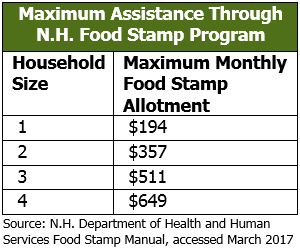

The New Hampshire Food Stamp Program New Hampshire Fiscal Policy Institute

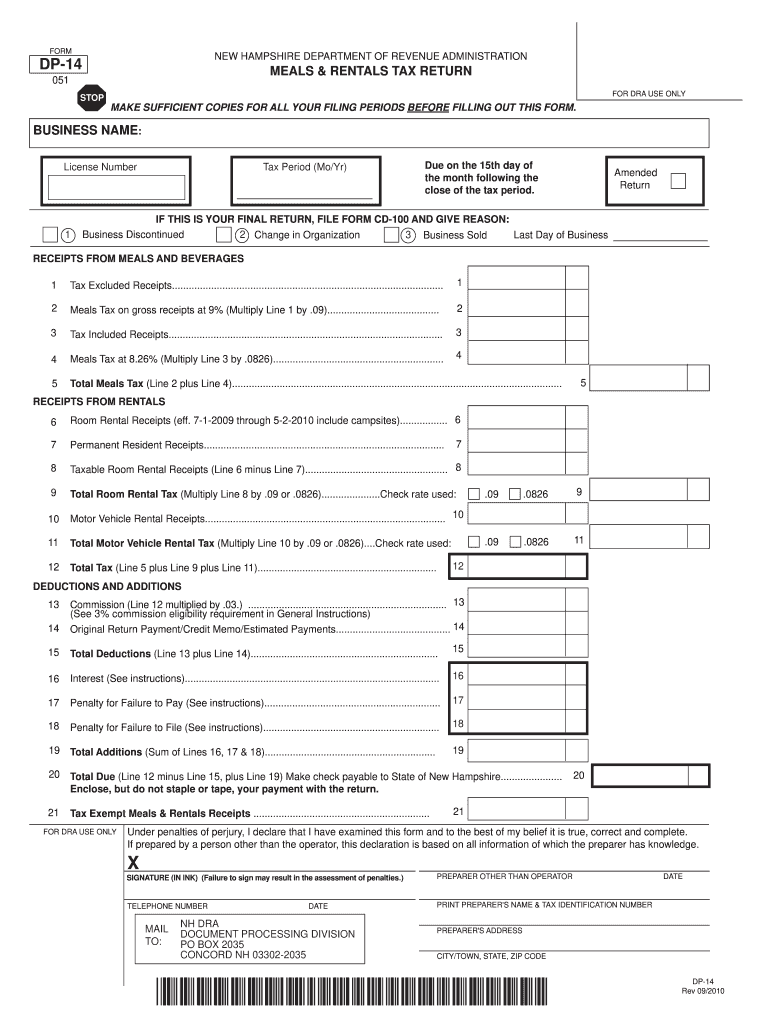

The tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants as well as on motor vehicle rentals.

. Enter your total Tax Excluded Receipts on Line 1 Excluded means that the tax is separately stated on the. Before Tax Price Sales Tax Rate. While New Hampshire does not tax your salary and wages there is a 5 tax on income earned from interest and dividends.

A sales tax is a consumption tax paid to a government on the sale of certain goods and. This tax is only paid. Amount of Tax Due X Daily Decimal Rate X Number of Days Late Per Period.

The portal allows users to file and amend returns view. Before-tax price sale tax rate and final or after-tax price. The State of New Hampshire does not issue Meals Rentals Tax exempt certificates.

Our calculator has been specially developed in order to. Census Bureau Number of cities that have local income taxes. Right click on the title link of the form you want to save.

Select Save Target As or Save Link As. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. A tax is imposed on taxable meals based upon the charge therefor as follows.

Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate. New Hampshire Salary Tax Calculator for the Tax Year 202122 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Starting october 1 the tax rate for the meals and rooms. If your account is under suit the tax office personnel will contact the Attorneys office to discuss the payment at that time. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055 cents per megawatt-hour on electricity and a.

New Hampshire income tax rate. Meals Tax at 7834 Multiply Line 3 by 07834 4 5. Meals and Rentals Tax Monthly Activity Reports - compiled and published by the NH Office of Strategic Initiatives For an up-to.

Starting on October 1 2021 the meals and rooms tax rate was decreased from 9 to 85. Open the form using. New Hampshire Personal Income Tax.

New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

The current tax on nh rooms and meals is currently 9. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9.

The MR Tax is paid by the consumer and is. New hampshire meals and rooms tax rate drops beginning friday. Choose a location to save the document and click Save 4.

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Tax Rates Rankings Nh State Taxes Tax Foundation

89 Greensward Dr Grantham Nh 03753 Home For Rent Realtor Com

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Sales Taxes In The United States Wikipedia

Home The New Hampshire Food Bank

Great Bay Food Truck Festival Town Of Stratham Nh

New Hampshire Sales Tax Rate 2022

:max_bytes(150000):strip_icc()/5_states_without_sales_tax-5bfc38cbc9e77c00519e5498.jpg)

Which States Have The Lowest Sales Tax

These Are The 10 Best Places To Live In New Hampshire

Business Nh Magazine Nh Tax Season Resources

Free Self Employed Tax Calculator View Your Potential Tax Obligation Instantly Hurdlr

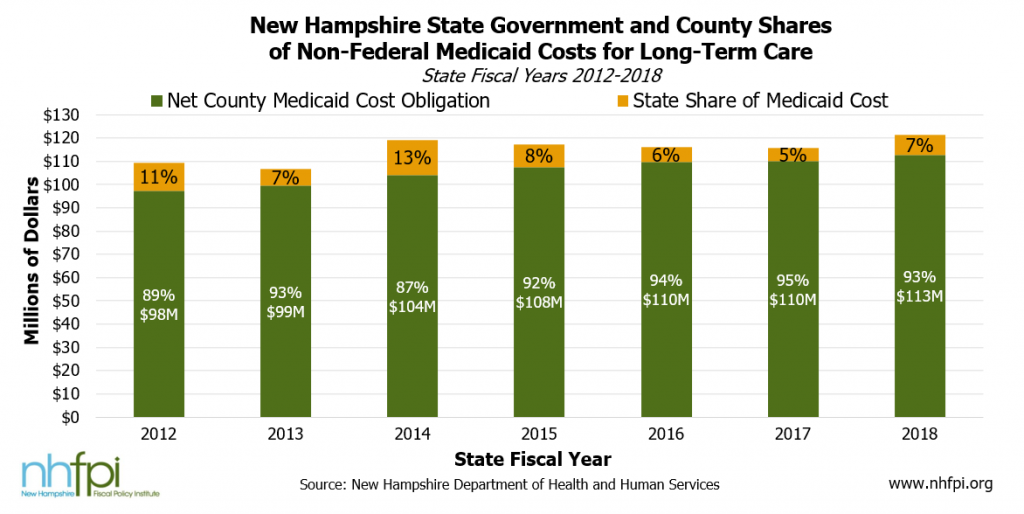

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

New Hampshire Sales Tax Handbook 2022

Nh Dor Dp 14 2010 Fill Out Tax Template Online Us Legal Forms